Buying a home is one of the most exciting yet daunting decisions you’ll ever make. With so many factors to consider, it’s easy to feel overwhelmed. One essential step in this journey is getting pre-approved for a mortgage. But what does that really mean? Think of pre-approval as your golden ticket is an official nod from lenders indicating how much they’re willing to lend you based on your financial profile. This process not only gives you an edge when making offers but also helps clarify your budget, ensuring you don’t fall in love with homes outside your reach. Ready to learn how to navigate the world of mortgage pre-approval? Let’s dive into everything you need to know.

Understanding the Importance of Pre-Approval

Pre-approval is more than just a piece of paper. It’s your financial roadmap in the homebuying journey. It signals to sellers that you’re a serious contender, ready to make an offer. Without pre-approval, you might find yourself at a disadvantage. In competitive markets, homes can fly off the market quickly. Sellers often prefer buyers who have already secured financing because it reduces uncertainty and speeds up the transaction process. Additionally, getting pre-approved helps you understand how much house you can afford. This clarity allows for smarter decision-making when browsing listings or attending open houses.

Steps to Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage can be a straightforward process if you follow the right steps. Start by researching lenders that suit your financial needs. Different institutions offer various rates and terms. Next, gather your financial information. This includes income statements, tax returns, and details about any debts you currently have. Lenders will want to see your overall financial picture. Once you’ve selected a lender, fill out their application form accurately. Don’t hesitate to ask questions if something is unclear.

Documents Required for Pre-Approval

When seeking mortgage pre-approval, having the right documents ready can streamline the process. Lenders typically ask for proof of income, so gather your pay stubs from the last few months. Tax returns for at least two years are also essential. Next, prepare bank statements to show your savings and assets. These help lenders assess your financial stability. If you’re self-employed, be sure to include profit-and-loss statements as well. Don’t forget about identification! A government-issued ID is usually required alongside your Social Security number. This verifies who you are and helps protect against fraud.

Benefits of Getting Pre-Approved

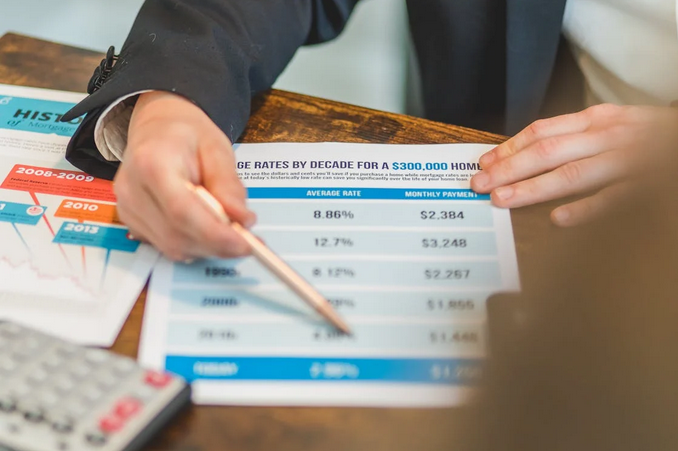

Getting pre-approved for a mortgage opens doors. It shows sellers you’re serious, giving you an edge in competitive markets. With this status, your offer carries more weight compared to those who are not pre-approved. Additionally, it clarifies your budget. Knowing how much money you can borrow helps streamline your home search. You avoid wasting time on properties beyond your financial reach. Another benefit is the ability to lock in interest rates early. This could save thousands over the life of your loan if rates rise before closing.

Common Mistakes to Avoid During the Pre-Approval Process

One of the biggest mistakes homebuyers make is not checking their credit report before applying for pre-approval. Surprises like errors or unexpected debts can derail your plans. Another common pitfall is changing jobs or making significant career moves during the process. Lenders want stability, and job changes might raise red flags about your income reliability. Many buyers also overlook small debts on their applications. Even minor loans can impact debt-to-income ratios, so be thorough when disclosing financial information.

Alternatives to Traditional Mortgage Pre-Approval

If traditional mortgage pre-approval isn’t the right fit for you, several alternatives may serve your needs better. One option is a “soft” pre-qualification. This process involves providing basic financial information to get an estimate of how much you might be able to borrow without impacting your credit score. Another alternative is a bank statement loan. Ideal for self-employed individuals, this type of financing evaluates income based on bank statements instead of tax returns, making it easier to qualify for a home loan. For those with unique financial situations, consider using private lenders or alternative mortgage solutions. These institutions often have more flexible criteria than conventional banks and may offer tailored options that suit your circumstances.

Navigating the mortgage pre-approval process can seem daunting at first. However, understanding its significance and following a clear path can make it manageable. By taking the time to gather the necessary documents and avoiding common pitfalls, you set yourself up for success in your home-buying journey. Remember that being pre-approved not only helps define your budget but also strengthens your position when making an offer on a property. With various alternatives available today, there’s no one-size-fits-all solution. Whether opting for traditional methods or exploring new options, informed decisions will ultimately lead to a smoother experience.…

Real estate investment companies are entities that actively

Real estate investment companies are entities that actively

AI-assisted e-commerce is revolutionizing the way businesses operate online. Thanks to AI’s ability to enhance customer experience, businesses can provide instant support to customers, answering their queries and helping them make purchasing decisions. These AI tech features are designed to understand natural language and can simulate human-like conversations.

AI-assisted e-commerce is revolutionizing the way businesses operate online. Thanks to AI’s ability to enhance customer experience, businesses can provide instant support to customers, answering their queries and helping them make purchasing decisions. These AI tech features are designed to understand natural language and can simulate human-like conversations. An AI-based digital marketing agency offers immense potential for businesses seeking profitable home-based opportunities. Leveraging cutting-edge technology enables marketers to streamline processes while delivering better results for clients. These can range from marketing planning to content creation and curation.

An AI-based digital marketing agency offers immense potential for businesses seeking profitable home-based opportunities. Leveraging cutting-edge technology enables marketers to streamline processes while delivering better results for clients. These can range from marketing planning to content creation and curation.

When hiring an office cleaning service, one of the first things you need to look for is a company that offers a guarantee. A guarantee gives you peace of mind knowing that if you’re unsatisfied with the results, they will come back and make it right. Companies that don’t offer a guarantee tell you they aren’t confident in their abilities. They may promise to do a good job, but without a guarantee, there’s no way to hold them accountable if they fall short.

When hiring an office cleaning service, one of the first things you need to look for is a company that offers a guarantee. A guarantee gives you peace of mind knowing that if you’re unsatisfied with the results, they will come back and make it right. Companies that don’t offer a guarantee tell you they aren’t confident in their abilities. They may promise to do a good job, but without a guarantee, there’s no way to hold them accountable if they fall short. Another consideration is whether or not their services are worth the value. After all, you want to get the most bang for your buck and ensure that you are getting a high-quality cleaning experience for your office space. However, some services are out there that don’t live up to their price tag. Watch out for companies that offer extremely low prices compared to other providers. While it may be tempting to go with these budget options, chances are they will cut corners regarding quality and attention to detail.

Another consideration is whether or not their services are worth the value. After all, you want to get the most bang for your buck and ensure that you are getting a high-quality cleaning experience for your office space. However, some services are out there that don’t live up to their price tag. Watch out for companies that offer extremely low prices compared to other providers. While it may be tempting to go with these budget options, chances are they will cut corners regarding quality and attention to detail. Agencies that don’t have a good reputation should be avoided at all costs. A reputable office cleaning agency will have positive reviews and feedback from satisfied clients. They will also have a track record of consistently delivering high-quality services. On the other hand, agencies with a poor reputation may have negative reviews or complaints about their work ethic, reliability, or customer service. Remember, when hiring an office cleaning service, you’re not just paying someone to tidy up; you’re investing in maintaining a clean and healthy working environment for yourself and your employees. Avoiding agencies without a good reputation ensures that this investment pays off in the long run.

Agencies that don’t have a good reputation should be avoided at all costs. A reputable office cleaning agency will have positive reviews and feedback from satisfied clients. They will also have a track record of consistently delivering high-quality services. On the other hand, agencies with a poor reputation may have negative reviews or complaints about their work ethic, reliability, or customer service. Remember, when hiring an office cleaning service, you’re not just paying someone to tidy up; you’re investing in maintaining a clean and healthy working environment for yourself and your employees. Avoiding agencies without a good reputation ensures that this investment pays off in the long run.

The first packing tip is to determine which items require special attention. Fragile items, such as china or glassware, need to be packed with extra care and labeled clearly so that movers are aware of their delicate nature. Wrap these items in bubble wrap before packing them away into a box.

The first packing tip is to determine which items require special attention. Fragile items, such as china or glassware, need to be packed with extra care and labeled clearly so that movers are aware of their delicate nature. Wrap these items in bubble wrap before packing them away into a box.

The design of the head influences the trajectory of shots, so it is important to pay attention to the shape of the head when selecting a Callaway Rogue St Max iron. Most models feature a large face with perimeter weighting for forgiveness.

The design of the head influences the trajectory of shots, so it is important to pay attention to the shape of the head when selecting a Callaway Rogue St Max iron. Most models feature a large face with perimeter weighting for forgiveness. Finally, it is important to keep the price of the clubs in mind when shopping for Callaway Rogue St Max irons. While these clubs are considered mid-range in terms of pricing, you should still take the time to compare prices across different retailers and websites to ensure that you’re getting the best deal.

Finally, it is important to keep the price of the clubs in mind when shopping for Callaway Rogue St Max irons. While these clubs are considered mid-range in terms of pricing, you should still take the time to compare prices across different retailers and websites to ensure that you’re getting the best deal.

One of the main benefits of blockchain technology is that it is incredibly secure. This is because blockchain uses a distributed ledger system, meaning no central control point exists. This makes it very difficult for hackers to target, as they would need to hack into every single node in the network to gain access to the data. These benefits make blockchain an attractive option for businesses looking to streamline their trade finance processes. If you’re considering using blockchain in your business, speak with a trade finance specialist to learn more about how it can help you.…

One of the main benefits of blockchain technology is that it is incredibly secure. This is because blockchain uses a distributed ledger system, meaning no central control point exists. This makes it very difficult for hackers to target, as they would need to hack into every single node in the network to gain access to the data. These benefits make blockchain an attractive option for businesses looking to streamline their trade finance processes. If you’re considering using blockchain in your business, speak with a trade finance specialist to learn more about how it can help you.…

One of the first things you should notice if your meat has gone bad is the smell. Fresh beef should have little to no scent, so it’s time to toss it out if yours is giving off a sour or ammonia-like smell. This is usually a sign that the meat has been sitting around for too long, and bacteria have started to form. If you’re not sure whether or not the meat is bad, give it a quick smell before cooking it. If it smells off, it’s best to err on caution and throw it out. It’s not worth risking food poisoning just to save a few dollars.

One of the first things you should notice if your meat has gone bad is the smell. Fresh beef should have little to no scent, so it’s time to toss it out if yours is giving off a sour or ammonia-like smell. This is usually a sign that the meat has been sitting around for too long, and bacteria have started to form. If you’re not sure whether or not the meat is bad, give it a quick smell before cooking it. If it smells off, it’s best to err on caution and throw it out. It’s not worth risking food poisoning just to save a few dollars. Now, you may not like this sign. But if you see bugs or mold crawling on your meat, that’s a surefire sign that it has gone bad. Bugs and mildew can cause food poisoning, so it’s best to get rid of the meat as soon as possible. If you see any bugs or mold on your meat, don’t hesitate to throw it out. It’s not worth the risk of getting sick. These are just a few telltale signs that your meat has gone bad. If you notice any of these, it’s best to err on the side of caution and get rid of the meat. It’s not worth risking food poisoning for a few dollars. So, next time you’re at the grocery store, get a fresh food delivery Dublin instead.…

Now, you may not like this sign. But if you see bugs or mold crawling on your meat, that’s a surefire sign that it has gone bad. Bugs and mildew can cause food poisoning, so it’s best to get rid of the meat as soon as possible. If you see any bugs or mold on your meat, don’t hesitate to throw it out. It’s not worth the risk of getting sick. These are just a few telltale signs that your meat has gone bad. If you notice any of these, it’s best to err on the side of caution and get rid of the meat. It’s not worth risking food poisoning for a few dollars. So, next time you’re at the grocery store, get a fresh food delivery Dublin instead.…

Creating a website is figuring out what you want your website to say. What is the purpose of your site? Are you trying to sell products? Share information? Connect with others? Once you have a clear idea of your message, you can start planning your content. Think about what kind of information you want to include on your website. If you are sharing information, you need to write articles or create a blog. Once you know what content you want to include, you can plan your site’s structure.

Creating a website is figuring out what you want your website to say. What is the purpose of your site? Are you trying to sell products? Share information? Connect with others? Once you have a clear idea of your message, you can start planning your content. Think about what kind of information you want to include on your website. If you are sharing information, you need to write articles or create a blog. Once you know what content you want to include, you can plan your site’s structure. Make sure that your site is optimized for search engines. This will help visitors find your site when searching for information on the internet. Start by choosing a keyword or phrase that represents your website. Use this keyword throughout your site, including the titles of your pages and the body of your content. In addition, be sure to add alt text to your images and videos. This will help search engines index your site and improve your ranking in search results. Creating a website can be a daunting task, but you can create a professional and engaging site with a bit of planning and effort.

Make sure that your site is optimized for search engines. This will help visitors find your site when searching for information on the internet. Start by choosing a keyword or phrase that represents your website. Use this keyword throughout your site, including the titles of your pages and the body of your content. In addition, be sure to add alt text to your images and videos. This will help search engines index your site and improve your ranking in search results. Creating a website can be a daunting task, but you can create a professional and engaging site with a bit of planning and effort.

Don’t you think it’s about time we start caring for our environment? If we want to live in an eco-friendly neighbourhood, installing a proper stormwater management system is first. This will prevent

Don’t you think it’s about time we start caring for our environment? If we want to live in an eco-friendly neighbourhood, installing a proper stormwater management system is first. This will prevent  Proper water management is critical for the environment and the quality of life of urban dwellers. Stormwater management systems help reduce flooding noise pollution and provide a more pleasant living environment.

Proper water management is critical for the environment and the quality of life of urban dwellers. Stormwater management systems help reduce flooding noise pollution and provide a more pleasant living environment. The final goal should be to modernize every urban community, one at a time. This can be done by installing proper stormwater management systems to prevent flooding and help preserve our natural resources. In addition, we should also support these efforts by educating ourselves on the issue and spreading the word to our friends and neighbours.

The final goal should be to modernize every urban community, one at a time. This can be done by installing proper stormwater management systems to prevent flooding and help preserve our natural resources. In addition, we should also support these efforts by educating ourselves on the issue and spreading the word to our friends and neighbours.

What’s best about mobile storage services is that they will deliver their portable storage container to your door. It means you don’t need to worry about taking care of your items.

What’s best about mobile storage services is that they will deliver their portable storage container to your door. It means you don’t need to worry about taking care of your items. Another reason you need to use this service is that it saves you money and time. With a self-storage unit, you have to rent a truck, drive to the team, load up your belongings, and then unload everything when you get there. But with a mobile storage container, all of this is taken care of for you. You don’t have to worry about renting a truck or hiring movers. In addition, you can store your belongings for as long as you need to. There are no minimum or maximum rental periods.

Another reason you need to use this service is that it saves you money and time. With a self-storage unit, you have to rent a truck, drive to the team, load up your belongings, and then unload everything when you get there. But with a mobile storage container, all of this is taken care of for you. You don’t have to worry about renting a truck or hiring movers. In addition, you can store your belongings for as long as you need to. There are no minimum or maximum rental periods.

There are some disadvantages to E-Class extinguishers, however. They must be placed in a visible location where all occupants of the building can see them. The pressure they exert while fighting fires is very high and could cause damage if released on accident or without proper training. An additional disadvantage concerning a traditional fire extinguisher is that an e-class extinguisher cannot be used on a fire involving burning metal. It would help if you were careful while extinguishing fires that require Class A, B, and C.

There are some disadvantages to E-Class extinguishers, however. They must be placed in a visible location where all occupants of the building can see them. The pressure they exert while fighting fires is very high and could cause damage if released on accident or without proper training. An additional disadvantage concerning a traditional fire extinguisher is that an e-class extinguisher cannot be used on a fire involving burning metal. It would help if you were careful while extinguishing fires that require Class A, B, and C.

There is a need to take into account the experience your lawyer has. You need to ask the different attorneys questions to determine whether the lawyer is the best fit for you. Make sure you check the lawyer’s website to check the cases they have handled in the past. Avoid attorneys who claim to have experience in several areas. Reputable lawyers specialize in certain areas of law. For instance, an attorney who has specialized in lemon law has handled cases such as yours. This will increase your chances of winning the case.

There is a need to take into account the experience your lawyer has. You need to ask the different attorneys questions to determine whether the lawyer is the best fit for you. Make sure you check the lawyer’s website to check the cases they have handled in the past. Avoid attorneys who claim to have experience in several areas. Reputable lawyers specialize in certain areas of law. For instance, an attorney who has specialized in lemon law has handled cases such as yours. This will increase your chances of winning the case. It is advisable to choose a reliable lemon law attorney to handle the case. However, you have to understand that all attorneys are not equal. You must be selective in the choice you make. Avoid lawyers asking you to cover a lot of costs and those not specialized in lemon law. Also, you need to avoid lawyers who take your case without consultation. If a lawyer gives your case to another lawyer, you should avoid such lawyers.…

It is advisable to choose a reliable lemon law attorney to handle the case. However, you have to understand that all attorneys are not equal. You must be selective in the choice you make. Avoid lawyers asking you to cover a lot of costs and those not specialized in lemon law. Also, you need to avoid lawyers who take your case without consultation. If a lawyer gives your case to another lawyer, you should avoid such lawyers.…

Putting the patient first is an indication that you will be receiving better treatment. The easiest way of considering a patient is by providing evening and early morning appointments. Most people have a busy schedule, and the convenience of coming after or before work can be a massive benefit to those who need treatment.

Putting the patient first is an indication that you will be receiving better treatment. The easiest way of considering a patient is by providing evening and early morning appointments. Most people have a busy schedule, and the convenience of coming after or before work can be a massive benefit to those who need treatment.

When it comes to purchasing shrooms online, there is a need to pay attention to the reputation of the seller. That is because you can only get the quality you want from a reliable online seller. Remember that you need a safe product. You can easily establish the reputation of an online seller by checking what the past customers say about the seller. Customer satisfaction is quite important when it comes to online shopping.

When it comes to purchasing shrooms online, there is a need to pay attention to the reputation of the seller. That is because you can only get the quality you want from a reliable online seller. Remember that you need a safe product. You can easily establish the reputation of an online seller by checking what the past customers say about the seller. Customer satisfaction is quite important when it comes to online shopping. With the above tricks and tips, you can purchase magic mushrooms online. There are many reasons to buy your shrooms online. For instance, you can compare the pricing and read reviews on different strains. In this way, you can determine the right product for you. Before you purchase any product online, you need to ensure the seller provides a secure payment gateway. You should avoid buying shrooms from illegitimate online shops. Also, you should ask for discounts if you want to save money.

With the above tricks and tips, you can purchase magic mushrooms online. There are many reasons to buy your shrooms online. For instance, you can compare the pricing and read reviews on different strains. In this way, you can determine the right product for you. Before you purchase any product online, you need to ensure the seller provides a secure payment gateway. You should avoid buying shrooms from illegitimate online shops. Also, you should ask for discounts if you want to save money.

Weather is one of the main things to consider when choosing the right holiday destination. Depending on the activities you plan to undertake, selecting the best season that suits them is crucial. It would be unreasonable to decide to go to the beach during the winter season or go ice skating during the summer. Therefore, when planning your holiday, consider the activities you wish to undertake and the appropriate weather to match them.

Weather is one of the main things to consider when choosing the right holiday destination. Depending on the activities you plan to undertake, selecting the best season that suits them is crucial. It would be unreasonable to decide to go to the beach during the winter season or go ice skating during the summer. Therefore, when planning your holiday, consider the activities you wish to undertake and the appropriate weather to match them. Whether you are taking the

Whether you are taking the

The role of these filters is to purify air, water and also oil. In manufacturing industries, it is essential to make sure that all the machines are running correctly.

The role of these filters is to purify air, water and also oil. In manufacturing industries, it is essential to make sure that all the machines are running correctly. There are two general types of filters. We have washable and replaceable filters. Washable filters need to be cleaned regularly so that they can work properly. With washable filters, you need to clean them after some time to remove the dirt and oils.

There are two general types of filters. We have washable and replaceable filters. Washable filters need to be cleaned regularly so that they can work properly. With washable filters, you need to clean them after some time to remove the dirt and oils.

translation job and someone else who proofreads the whole work. These agencies are capable of handling the excess workload, and therefore, you do not need to worry about beating your deadlines. They will do all the job accurately despite the pressure. You should look for the best translation service provider to get the best services. The following are some of the things you need to consider when choosing one:

translation job and someone else who proofreads the whole work. These agencies are capable of handling the excess workload, and therefore, you do not need to worry about beating your deadlines. They will do all the job accurately despite the pressure. You should look for the best translation service provider to get the best services. The following are some of the things you need to consider when choosing one: had the chance of working with such companies. Testimonials from people who have had the experience of working with the different translation services can be of great help. You can ask everything you need to know to be on the safe side.…

had the chance of working with such companies. Testimonials from people who have had the experience of working with the different translation services can be of great help. You can ask everything you need to know to be on the safe side.…

Moreover, potential customers hope to find you on the search engines. Remember that people will search for your products and services on popular search engines such as Google. According to Dux Digital, if you have not invested in SEO, your business is not likely to appear in top search results. Thus, your website can be considered useless, if you cannot find it. The following are some of the reasons to consider SEO:

Moreover, potential customers hope to find you on the search engines. Remember that people will search for your products and services on popular search engines such as Google. According to Dux Digital, if you have not invested in SEO, your business is not likely to appear in top search results. Thus, your website can be considered useless, if you cannot find it. The following are some of the reasons to consider SEO: With good SEO, you are bound to get a continuous flow of traffic to your website. The good thing about search engine optimization is that you will get long lasting results. Thus, it is necessary to look for appropriate keywords to rank on search engines. In this way, you can get potential leads looking for your services or products. By ranking high on search engines, this does not mean that you are sound and safe. However, you should remember that rankings can change. Thus, never assume that you will stick there forever.…

With good SEO, you are bound to get a continuous flow of traffic to your website. The good thing about search engine optimization is that you will get long lasting results. Thus, it is necessary to look for appropriate keywords to rank on search engines. In this way, you can get potential leads looking for your services or products. By ranking high on search engines, this does not mean that you are sound and safe. However, you should remember that rankings can change. Thus, never assume that you will stick there forever.…

The first important thing to look at is the size of the room or the area to be covered. The most common sizes of rugs are 4 by 6 and 6 by 9 feet. They work perfectly under the coffee table. If you want something that will cover the house, then go for an 8 by 10 feet rug.

The first important thing to look at is the size of the room or the area to be covered. The most common sizes of rugs are 4 by 6 and 6 by 9 feet. They work perfectly under the coffee table. If you want something that will cover the house, then go for an 8 by 10 feet rug. The shape of the rug should be determined by the decorating style. Many people are always looking for rectangular shaped rugs. Do not limit yourself to this shape; there are many others. An octagonal or circular shape can add more elegance to your room.

The shape of the rug should be determined by the decorating style. Many people are always looking for rectangular shaped rugs. Do not limit yourself to this shape; there are many others. An octagonal or circular shape can add more elegance to your room.

As a parent, you should ensure that you have a television set in your house as it will help you have great valuable time with your children. One of the most excellent ways of spending time with your family is by watching television together. However, one of the things that you should note as far as viewing is concerned is that you should limit the viewing hours.

As a parent, you should ensure that you have a television set in your house as it will help you have great valuable time with your children. One of the most excellent ways of spending time with your family is by watching television together. However, one of the things that you should note as far as viewing is concerned is that you should limit the viewing hours. Watching movies

Watching movies

Another important factor to consider when in search of HID lights is the warranty. Always remember that there is no such thing as perfect products. For this reason, safeguard the investment by only opting for HID lights with warranty periods. Moreover, always remember that those HID lights without warranty are likely to be made of poor quality.

Another important factor to consider when in search of HID lights is the warranty. Always remember that there is no such thing as perfect products. For this reason, safeguard the investment by only opting for HID lights with warranty periods. Moreover, always remember that those HID lights without warranty are likely to be made of poor quality.

Every entrepreneur knows that they have to keep tabs with the business expenses and bills. It is important to settle on a scalable virtual assistant that provides the best bookkeeping solutions that match your business needs. Furthermore, they will help you accurately calculate the VAT return. The financial aspect of a business can be rather daunting, especially if you are unfamiliar with the technicalities involved in achieving a business that is financially sound. Consequently, you will concentrate on what you do best and be up-to-date with your books.

Every entrepreneur knows that they have to keep tabs with the business expenses and bills. It is important to settle on a scalable virtual assistant that provides the best bookkeeping solutions that match your business needs. Furthermore, they will help you accurately calculate the VAT return. The financial aspect of a business can be rather daunting, especially if you are unfamiliar with the technicalities involved in achieving a business that is financially sound. Consequently, you will concentrate on what you do best and be up-to-date with your books. Business trips frequently occur, especially as you gain more business grounds. It can be quite challenging to identify the best business destination based on the level of your business. Additionally, you can reduce the stress related to planning a business strip as well as the travel costs by seeking the services of a professional virtual assistance.

Business trips frequently occur, especially as you gain more business grounds. It can be quite challenging to identify the best business destination based on the level of your business. Additionally, you can reduce the stress related to planning a business strip as well as the travel costs by seeking the services of a professional virtual assistance.

Reverse osmosis is an effective water treatment plan and can be used to balance both acidic and basic constituents of water hence minimizing incidences of bone or teeth diseases. Lastly, with this system, you enjoy a tasteless cup of water anytime you wish. This may not always be the case for municipal water supplies.

Reverse osmosis is an effective water treatment plan and can be used to balance both acidic and basic constituents of water hence minimizing incidences of bone or teeth diseases. Lastly, with this system, you enjoy a tasteless cup of water anytime you wish. This may not always be the case for municipal water supplies.

The faculty

The faculty

mization

mization A Monroe piercing is a lip piercing positioned off-center, over the left-hand side of the upper lip and is destined to look like the beauty spot of the Hollywood celebrity, Marilyn Monroe. Most women with this piercing favor a jewel or a metal ball on the external end. The lip can habitually swell significantly following the piercing and will require both oral and facial aftercare to maintain both sides of the jewelry sparkling at all times. Similar to all piercings, this style of piercing is likely to infect, so it needs a regular cleaning. However, if appropriately maintained, scarring will be less to none.

A Monroe piercing is a lip piercing positioned off-center, over the left-hand side of the upper lip and is destined to look like the beauty spot of the Hollywood celebrity, Marilyn Monroe. Most women with this piercing favor a jewel or a metal ball on the external end. The lip can habitually swell significantly following the piercing and will require both oral and facial aftercare to maintain both sides of the jewelry sparkling at all times. Similar to all piercings, this style of piercing is likely to infect, so it needs a regular cleaning. However, if appropriately maintained, scarring will be less to none. The level of soreness experienced during the piercing procedure will vary between individuals and it counts on the specific piercing location, as well. Those having well-exercised facial muscles or thicker lips will have more muscle or flesh to pierce, so they may feel more distress. When compared to women, men may feel a little more pain because their frequent shaving can make their upper lip skin harder and tougher to pierce. The sphincter muscle about the mouth is used in the playing of woodwind and brass instruments. Consequently, artists who play these instruments are inclined to have a superior muscle around their mouth, and they may experience more distress during the process of piercing.

The level of soreness experienced during the piercing procedure will vary between individuals and it counts on the specific piercing location, as well. Those having well-exercised facial muscles or thicker lips will have more muscle or flesh to pierce, so they may feel more distress. When compared to women, men may feel a little more pain because their frequent shaving can make their upper lip skin harder and tougher to pierce. The sphincter muscle about the mouth is used in the playing of woodwind and brass instruments. Consequently, artists who play these instruments are inclined to have a superior muscle around their mouth, and they may experience more distress during the process of piercing.

Going for a religious outing is another great instance when hiring a bus will be a good idea. With everyone on the bus together, it will be easier to sing and worship, or do any other fun activity along the way. The members will also use this as a great opportunity to bond with each other further. Everyone in the bus will get a sense of belonging. It will also be an easy way to account for everyone and ensure no one is left behind.

Going for a religious outing is another great instance when hiring a bus will be a good idea. With everyone on the bus together, it will be easier to sing and worship, or do any other fun activity along the way. The members will also use this as a great opportunity to bond with each other further. Everyone in the bus will get a sense of belonging. It will also be an easy way to account for everyone and ensure no one is left behind.

n individual can do to prevent one from feeling the negative effects of using deodorants that have chemicals is to revert to using natural deodorants. Therefore, we can recommend that one uses the natural deodorants for kids because they are not only good for the individual but also advantageous to those around them and the environment as a whole. These advantages include:

n individual can do to prevent one from feeling the negative effects of using deodorants that have chemicals is to revert to using natural deodorants. Therefore, we can recommend that one uses the natural deodorants for kids because they are not only good for the individual but also advantageous to those around them and the environment as a whole. These advantages include: een in the process of looking for natural remedies for curing excessive sweating then definitely you have a solution in natural deodorants. It is advisable that rather than using potentially dangerous antiperspirants or money consuming and expensive treatments you should try out the natural deodorants because they have been tested and proven to be the best cure for this since they will regulate and reduce your sweating levels to normal.

een in the process of looking for natural remedies for curing excessive sweating then definitely you have a solution in natural deodorants. It is advisable that rather than using potentially dangerous antiperspirants or money consuming and expensive treatments you should try out the natural deodorants because they have been tested and proven to be the best cure for this since they will regulate and reduce your sweating levels to normal.

The reputation of a company is an important factor to consider during skip hire and in contracting the services of waste removal companies. A reputable company has a track record of efficient customer service. It values customer feedback and takes steps to address them accordingly. Such companies also provide skip bins that can meet customer needs and aid in the effective collection of waste. Does the company that you intend to contract its services have an official line of communication? Can you reach it in case there is a problem with the garbage collection bins that it has supplied? Reputable companies also collect waste material on time and dispose of them in the designated areas. You should, therefore, ensure that the company which you enter into an agreement with for waste collection and disposal or skip has a proven track record of excellent services. It is always prudent to ask for the relevant certifications that give the company the go-ahead to operate in that line of business.

The reputation of a company is an important factor to consider during skip hire and in contracting the services of waste removal companies. A reputable company has a track record of efficient customer service. It values customer feedback and takes steps to address them accordingly. Such companies also provide skip bins that can meet customer needs and aid in the effective collection of waste. Does the company that you intend to contract its services have an official line of communication? Can you reach it in case there is a problem with the garbage collection bins that it has supplied? Reputable companies also collect waste material on time and dispose of them in the designated areas. You should, therefore, ensure that the company which you enter into an agreement with for waste collection and disposal or skip has a proven track record of excellent services. It is always prudent to ask for the relevant certifications that give the company the go-ahead to operate in that line of business. Pricing matters because it is always a good idea to go for a product or service within your budget. Price comparison on websites or through referrals can help you identify the best skip hire services or waste removal companies for your needs. Price, however, should not be considered as a stand-alone factor because it is measured against other issues. A company can offer cheap but sub-standard services. Some waste removal companies, on the other hand, provide excellent services with premium prices. Strive to strike a balance between the quality of services offered and the prices charged. The above factors, when considered during skip hire and the engagement of the services of waste removal companies, can help you get the best waste collection services available.…

Pricing matters because it is always a good idea to go for a product or service within your budget. Price comparison on websites or through referrals can help you identify the best skip hire services or waste removal companies for your needs. Price, however, should not be considered as a stand-alone factor because it is measured against other issues. A company can offer cheap but sub-standard services. Some waste removal companies, on the other hand, provide excellent services with premium prices. Strive to strike a balance between the quality of services offered and the prices charged. The above factors, when considered during skip hire and the engagement of the services of waste removal companies, can help you get the best waste collection services available.…

The Pros & Cons

The Pros & Cons

If somebody mentioned that you could enjoy over 36 flavors of different e-liquids, you would probably brush them off as liars. However, Mist gives you this and more. From them, you can get the popular flavors like strawberry and the most creative flavors you can imagine. Their website explains in details all the flavors they offer. Most people have given positive feedbacks about this company and claim to have found the right flavors which increase their vaping experience. Join this group of happy clients as well.

If somebody mentioned that you could enjoy over 36 flavors of different e-liquids, you would probably brush them off as liars. However, Mist gives you this and more. From them, you can get the popular flavors like strawberry and the most creative flavors you can imagine. Their website explains in details all the flavors they offer. Most people have given positive feedbacks about this company and claim to have found the right flavors which increase their vaping experience. Join this group of happy clients as well. Their online shop is one of the best shopping experience ever. Even without any guideline, you can be sure to navigate through and locate your favorite product. Once added to the get, the check out is yet another simple procedure. Payment systems are safe, and order processing is fast. Their website is not complete without the numerous offers and discounts. Check their website now through the above link to see the current discounts.

Their online shop is one of the best shopping experience ever. Even without any guideline, you can be sure to navigate through and locate your favorite product. Once added to the get, the check out is yet another simple procedure. Payment systems are safe, and order processing is fast. Their website is not complete without the numerous offers and discounts. Check their website now through the above link to see the current discounts.

The photo booth rental will have different types of prop backgrounds that they will provide you with, or you can also make your background. The area around the background should be about 15 feet by 10 feet that will allow you to have the right amount of room. Lights are critical too; you always need to have the right type of lighting behind the picture.…

The photo booth rental will have different types of prop backgrounds that they will provide you with, or you can also make your background. The area around the background should be about 15 feet by 10 feet that will allow you to have the right amount of room. Lights are critical too; you always need to have the right type of lighting behind the picture.…

electrical world. Many electricians usually attend a regular training course.

electrical world. Many electricians usually attend a regular training course. An electricians insurance will cover losses during the line of work. The insurance should also cover the neighbor’s property in case of accidents. When getting an electrician, be sure to ask if they have insurance. Before hiring one, you should ask about insurance. Qualified electricians will have a warranty to show that they are behind their work.

An electricians insurance will cover losses during the line of work. The insurance should also cover the neighbor’s property in case of accidents. When getting an electrician, be sure to ask if they have insurance. Before hiring one, you should ask about insurance. Qualified electricians will have a warranty to show that they are behind their work.

you will not just be an average player but a top player because you will have unlimited gems and coins at your disposal that will help you build walls and buy the best cards. You will no doubt be that force to reckon with as far as the game is concerned.

you will not just be an average player but a top player because you will have unlimited gems and coins at your disposal that will help you build walls and buy the best cards. You will no doubt be that force to reckon with as far as the game is concerned. Many people have wondered why the clash royale should be hacked. The primary reason for using the hacked clash royal is that the players have a more enjoyable time in the clash royale. Rather than spending hundreds of dollars in obtaining the best legendary cards, the hacked clash royale provides you with the best card without having to pay a dime. This, therefore, grants the player sufficient time to concentrate on the important things, and that is the gameplay.

Many people have wondered why the clash royale should be hacked. The primary reason for using the hacked clash royal is that the players have a more enjoyable time in the clash royale. Rather than spending hundreds of dollars in obtaining the best legendary cards, the hacked clash royale provides you with the best card without having to pay a dime. This, therefore, grants the player sufficient time to concentrate on the important things, and that is the gameplay.

e the way to go. All countries in the world accept the value of precious metals, and this makes it easy to trade worldwide. Gold, silver, platinum and other types of metals can be sold worldwide.

e the way to go. All countries in the world accept the value of precious metals, and this makes it easy to trade worldwide. Gold, silver, platinum and other types of metals can be sold worldwide.

s a result of poor management, poor marketing, and the entrepreneur’s inability to manage resources. Therefore, before you begin your feasibility study on the idea and the market you want to venture, you should evaluate your desires, goals, and talents. Take into account the willingness of taking risks and amount of energy and time you require to make your business success. Also, you need to review your personnel, marketing, and financial skills to ensure you have the necessary background to achieve success in your business.

s a result of poor management, poor marketing, and the entrepreneur’s inability to manage resources. Therefore, before you begin your feasibility study on the idea and the market you want to venture, you should evaluate your desires, goals, and talents. Take into account the willingness of taking risks and amount of energy and time you require to make your business success. Also, you need to review your personnel, marketing, and financial skills to ensure you have the necessary background to achieve success in your business. ot complete evaluating a business opportunity without analyzing risks associated with it. You need an honest appraisal of potential risks that are inherent to your business. It is from this that you will decide whether the risks are worth your investment. Some of the things to consider in this case include state of the economy, competition, type of employees you need, and much more.

ot complete evaluating a business opportunity without analyzing risks associated with it. You need an honest appraisal of potential risks that are inherent to your business. It is from this that you will decide whether the risks are worth your investment. Some of the things to consider in this case include state of the economy, competition, type of employees you need, and much more.

The body type of a drone will substantially influence its price. Drones that take the most basic form tend to be cheaper compared to those that come in sophisticated and eye catchy style. There are two distinct shapes. These are the tailless quadcopters and the tailed mono and bi-copters. As stated earlier, the difference in price is brought about by the features of the drone in question. Cheap drones, for instance, will have essential body functions. That is because they are used for the most basic functions.

The body type of a drone will substantially influence its price. Drones that take the most basic form tend to be cheaper compared to those that come in sophisticated and eye catchy style. There are two distinct shapes. These are the tailless quadcopters and the tailed mono and bi-copters. As stated earlier, the difference in price is brought about by the features of the drone in question. Cheap drones, for instance, will have essential body functions. That is because they are used for the most basic functions. Different drones are used to perform certain distinct functions. Cheap drones tend to have few add-on features. For instance, they may not be fitted with cameras. When they have been equipped with cameras, they are usually low-quality cameras with fewer pixels. Drones that use sophisticated cameras are meant for professional use. Therefore, they cost a lot.…

Different drones are used to perform certain distinct functions. Cheap drones tend to have few add-on features. For instance, they may not be fitted with cameras. When they have been equipped with cameras, they are usually low-quality cameras with fewer pixels. Drones that use sophisticated cameras are meant for professional use. Therefore, they cost a lot.…

Using New Car models

Using New Car models

Go for a flattering cut. Tunics are more flattering than other garments due to their generous cut. Ensure that what you pick fits in all the right places and hangs correctly. Longer tunics may seem to be more flattering than shorter ones. A good tunic needs to be well made as well as well designed. Good quality stitching will create steady seams while poor quality sewing compromises the quality of the tunic.

Go for a flattering cut. Tunics are more flattering than other garments due to their generous cut. Ensure that what you pick fits in all the right places and hangs correctly. Longer tunics may seem to be more flattering than shorter ones. A good tunic needs to be well made as well as well designed. Good quality stitching will create steady seams while poor quality sewing compromises the quality of the tunic. Tunics are versatile pieces of clothing that can be worn by women of all shapes and sizes. Different styles are more flattering for specific body shapes than others, so before purchasing a tunic, a woman needs to know what shape her body type is. Explore the different types of tunics to determine which cuts, styles, and patterns work best with your body type. No matter what style or size of tunic a woman is looking for, she’ll find a huge selection of tunics from retailers…

Tunics are versatile pieces of clothing that can be worn by women of all shapes and sizes. Different styles are more flattering for specific body shapes than others, so before purchasing a tunic, a woman needs to know what shape her body type is. Explore the different types of tunics to determine which cuts, styles, and patterns work best with your body type. No matter what style or size of tunic a woman is looking for, she’ll find a huge selection of tunics from retailers…

architect and give them a rough drawing or sketch and explain their idea and what they want. The designer would then proceed to make a drawing to scale taking into account all the details given by you, the size, number of rooms and they will also provide an estimate of the required building materials. However, this is the

architect and give them a rough drawing or sketch and explain their idea and what they want. The designer would then proceed to make a drawing to scale taking into account all the details given by you, the size, number of rooms and they will also provide an estimate of the required building materials. However, this is the  An architect will have to be employed when you want to design a building. However, many companies will do both services including 3D rendering. The cost for this service will vary depending on the complexity and size of the structure. It will take a bit of time to complete, but it will be well worth it as the client can see how the finished building will look and make any changes if they wish to.

An architect will have to be employed when you want to design a building. However, many companies will do both services including 3D rendering. The cost for this service will vary depending on the complexity and size of the structure. It will take a bit of time to complete, but it will be well worth it as the client can see how the finished building will look and make any changes if they wish to. Having your backyard is something great. However, a garden that is not well-taken care off may affect the overall look of your home. There are a lot of ideas that can turn your garden into something extraordinary. If you are looking for garden ideas, we have compiled a plethora of ideas to help get you started planning the garden you have always envisioned.

Having your backyard is something great. However, a garden that is not well-taken care off may affect the overall look of your home. There are a lot of ideas that can turn your garden into something extraordinary. If you are looking for garden ideas, we have compiled a plethora of ideas to help get you started planning the garden you have always envisioned. Cleanness is an important thing, plant flowers in an organized manner to avowing overgrowth and making maintenance difficult. Instead of planting too many flowers, it is advisable to keep your design simple. Focus on important issues for your backyard such as planting shrubs, grass and flowers artfully covering your garden.

Cleanness is an important thing, plant flowers in an organized manner to avowing overgrowth and making maintenance difficult. Instead of planting too many flowers, it is advisable to keep your design simple. Focus on important issues for your backyard such as planting shrubs, grass and flowers artfully covering your garden. The sense of frustration has become rampant in almost everyone’s life poor financial management resulting in debts. Building wealth has become a complex, confusing, big elephant to swallow. You don’t have to become a debt expert to know what is necessary and what is not. Worry not, a debt coach will not only help you spend within your budget but will also help you change some of your long held beliefs to get your life back on track.

The sense of frustration has become rampant in almost everyone’s life poor financial management resulting in debts. Building wealth has become a complex, confusing, big elephant to swallow. You don’t have to become a debt expert to know what is necessary and what is not. Worry not, a debt coach will not only help you spend within your budget but will also help you change some of your long held beliefs to get your life back on track.